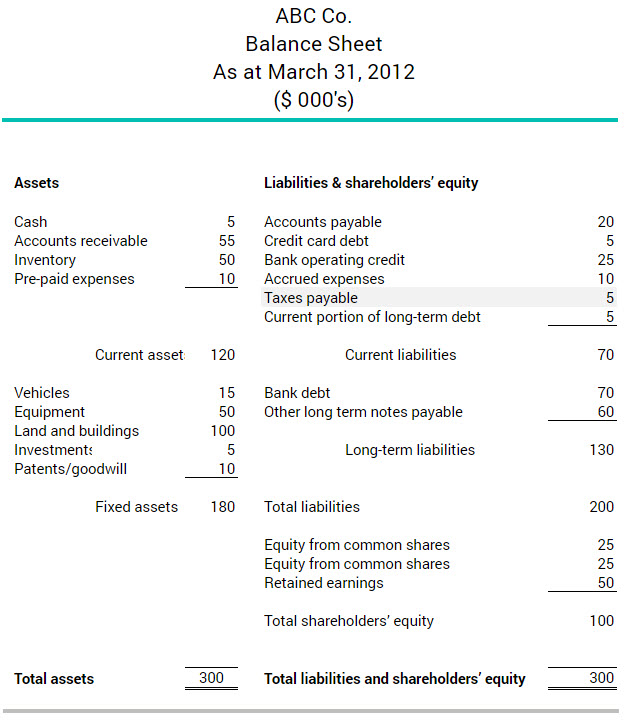

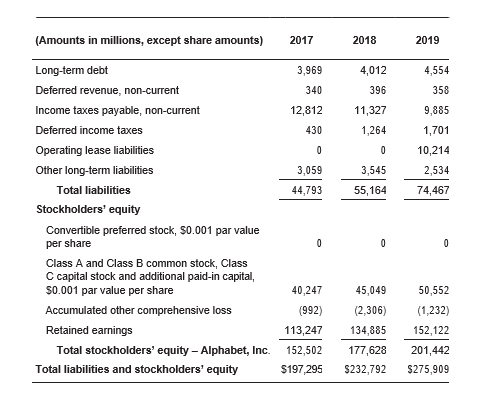

Complex Balance Sheet Presented below is the unaudited balance sheet as of December 31, 2019, prepared by Zeus Manufacturing Corporation's bookkeeper. Your company has been engaged to perform an audit, during which

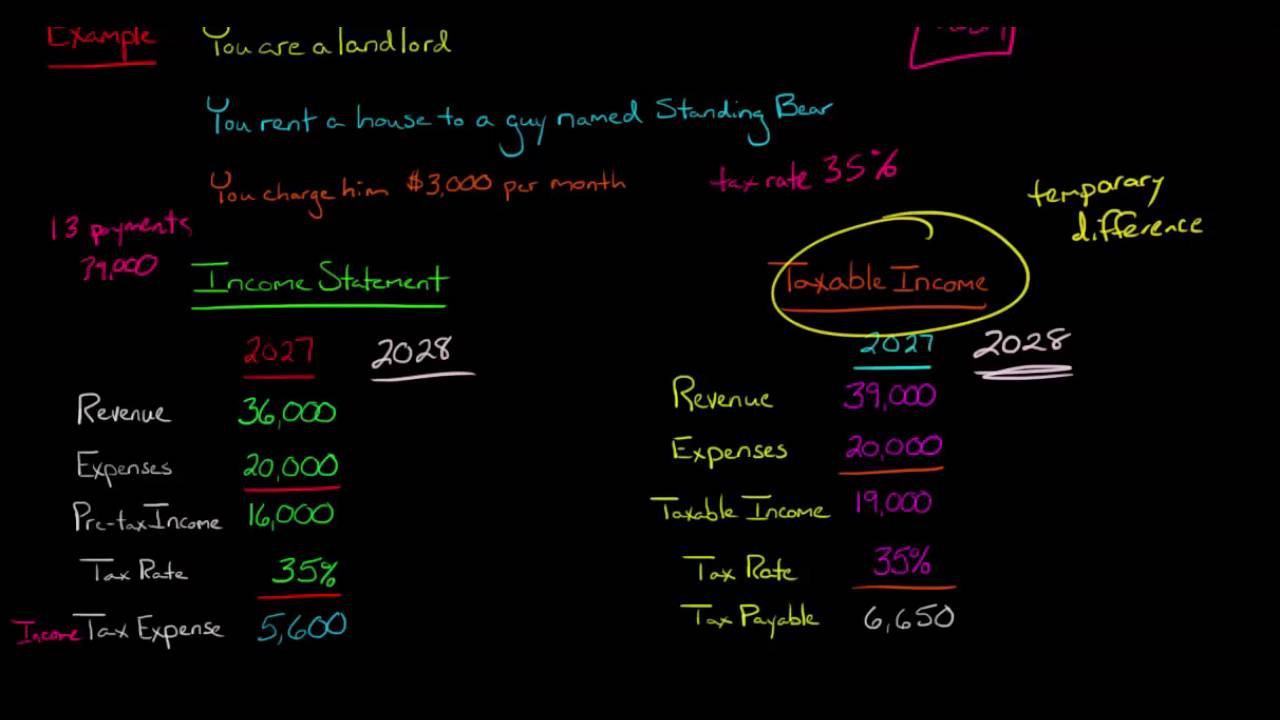

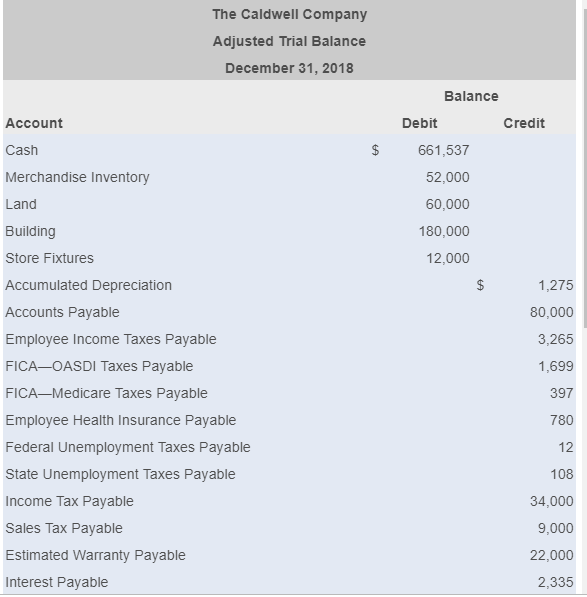

Payroll Journal Entries: Financial Statements & Balance Sheets - Video & Lesson Transcript | Study.com

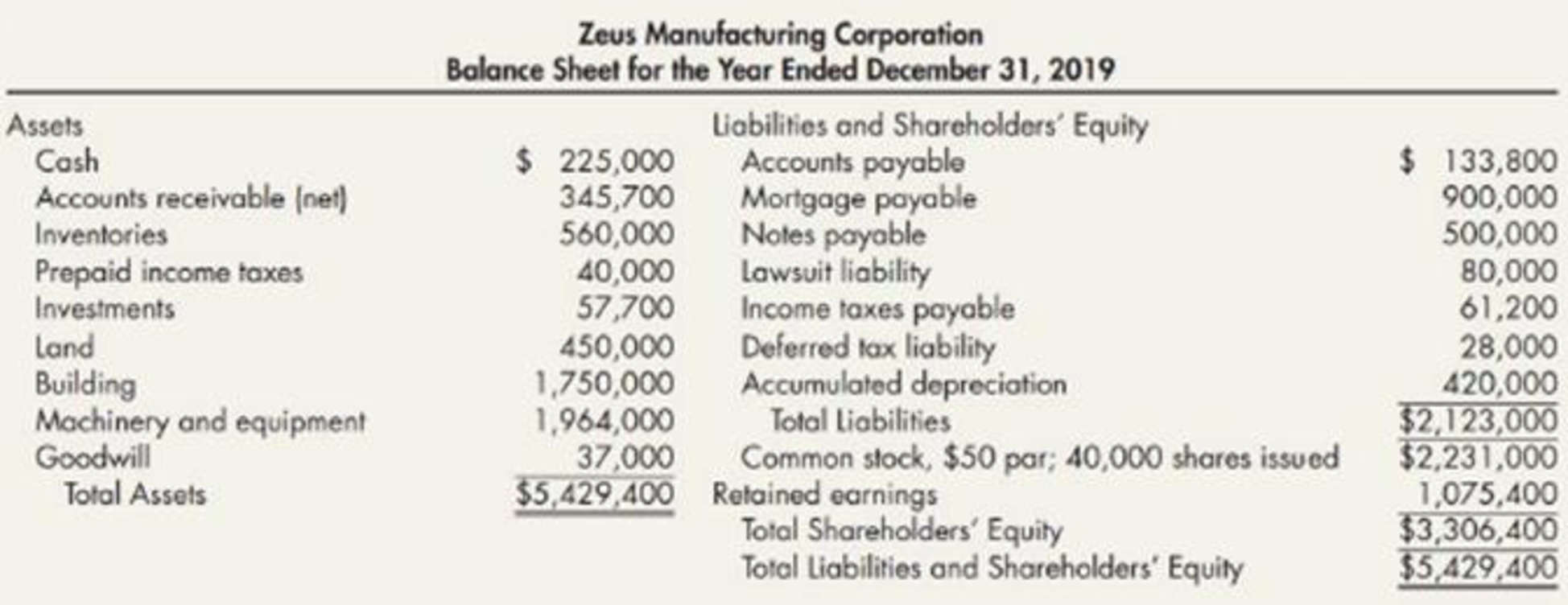

![Chapter 12: Income Tax Expense and Its Liability - How to Read a Financial Report: Wringing Vital Signs Out of the Numbers, 8th Edition [Book] Chapter 12: Income Tax Expense and Its Liability - How to Read a Financial Report: Wringing Vital Signs Out of the Numbers, 8th Edition [Book]](https://www.oreilly.com/api/v2/epubs/9781118735589/files/images/f090-01.jpg)

![Solved] The following balance sheet and income st | SolutionInn Solved] The following balance sheet and income st | SolutionInn](https://dsd5zvtm8ll6.cloudfront.net/si.question.images/images/question_images/1543/4/8/9/9615bffc9a91521b1543472482017.jpg)

![12 INCOME TAX EXPENSE AND ITS LIABILITY - How to Read a Financial Report, 9th Edition [Book] 12 INCOME TAX EXPENSE AND ITS LIABILITY - How to Read a Financial Report, 9th Edition [Book]](https://www.oreilly.com/api/v2/epubs/9781119606468/files/images/c12ex001.jpg)